Introduction

Semiconductors are not just technological marvels; they are the linchpin of the global economy. From consumer electronics and automotive systems to data centers and defense applications, nearly every modern industry relies on semiconductor components. The global semiconductor industry has evolved into a highly complex, interdependent ecosystem, involving design houses, fabrication plants (fabs), equipment manufacturers, and raw material suppliers spread across multiple continents.

The importance of semiconductors was starkly highlighted during the global chip shortage of 2020–2022, which disrupted automobile production, consumer electronics, and industrial supply chains. This unprecedented situation underscored the strategic significance of semiconductors, prompting governments and companies to rethink manufacturing, supply chain resilience, and technological sovereignty.

This article provides an in-depth analysis of the global semiconductor industry, focusing on its structure, key players, supply chain dynamics, market trends, geopolitical influences, and future growth opportunities.

1. Industry Structure and Value Chain

1.1 Segmentation of the Semiconductor Industry

The semiconductor industry can be broadly segmented into three categories:

- Design (Fabless Companies)

- These companies focus on chip design and intellectual property (IP) development without owning fabrication facilities.

- Notable examples: Qualcomm, NVIDIA, AMD.

- They rely on contract manufacturers to produce chips, benefiting from flexibility and lower capital expenditure.

- Manufacturing (Foundries)

- Foundries specialize in fabricating semiconductor wafers based on customer designs.

- Leading players: TSMC, Samsung Foundry, GlobalFoundries.

- They invest billions of dollars in state-of-the-art fabs and advanced lithography tools.

- Integrated Device Manufacturers (IDMs)

- Companies that handle both design and manufacturing, maintaining control over the entire production process.

- Examples: Intel, Micron, Texas Instruments.

- IDMs benefit from proprietary manufacturing techniques but face higher capital requirements.

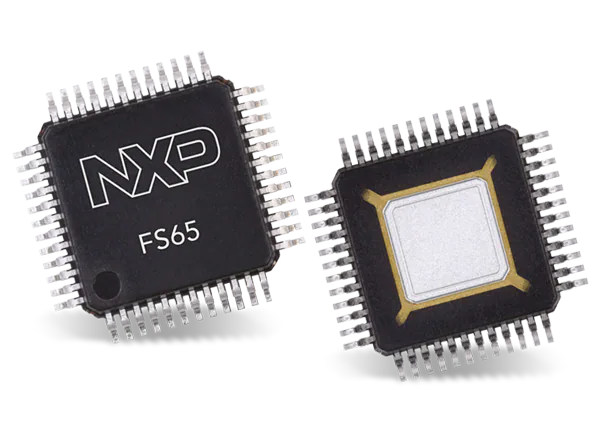

Other segments include equipment suppliers (ASML, Applied Materials), EDA software providers (Cadence, Synopsys), and raw material suppliers (silicon, specialty gases, chemicals).

1.2 The Supply Chain Ecosystem

The semiconductor supply chain is intricate and globalized:

- Raw Materials: High-purity silicon, rare earth metals, photomasks, and specialty gases.

- Equipment: Lithography machines, deposition systems, etching tools.

- Design: EDA software, IP cores, verification tools.

- Fabrication: Wafers processed in cleanrooms with nanoscale precision.

- Assembly, Testing, and Packaging (ATP): Chips are diced, tested, and packaged before integration into end products.

Disruptions in any segment—whether natural disasters, geopolitical tensions, or equipment shortages—can have cascading effects throughout the industry.

2. Key Players and Market Share

The semiconductor industry is highly concentrated, with a handful of companies controlling advanced technology and production capabilities.

2.1 Leading Foundries

- TSMC (Taiwan Semiconductor Manufacturing Company)

- Market leader in advanced nodes (5 nm, 3 nm).

- Serves high-profile clients like Apple, NVIDIA, AMD.

- Strategic importance: Taiwan’s geopolitical stability is crucial for global chip supply.

- Samsung Foundry

- Strong presence in memory and logic chips.

- Competes aggressively in advanced nodes and 3D packaging.

- GlobalFoundries

- Focuses on mature nodes for automotive and industrial applications.

2.2 Integrated Device Manufacturers

- Intel

- Traditionally dominant in CPUs and chip fabrication.

- Faces challenges from TSMC’s advanced node leadership.

- Micron, Texas Instruments

- Specialize in memory and analog semiconductors.

2.3 Fabless Giants

- Qualcomm: Mobile processors and 5G solutions.

- NVIDIA: GPUs for gaming, AI, and data centers.

- AMD: CPUs and GPUs competing with Intel and NVIDIA.

2.4 Regional Concentration

- Asia: Dominates production (Taiwan, South Korea, China, Japan).

- United States: Leads in design, R&D, and advanced process equipment.

- Europe: Focused on automotive semiconductors and high-end sensors.

3. Market Dynamics and Trends

3.1 Cyclical Nature of the Industry

The semiconductor market is inherently cyclical, influenced by:

- Consumer demand fluctuations (smartphones, PCs).

- Industrial cycles (automotive, automation).

- Technological transitions (new nodes, AI adoption).

During downturns, overcapacity can lead to pricing pressure, while in upturns, demand can outstrip supply, causing shortages.

3.2 Emerging Applications Driving Demand

- Artificial Intelligence (AI): Specialized chips (AI accelerators) require high computational throughput and energy efficiency.

- Automotive: Electric vehicles (EVs) and autonomous driving systems rely on semiconductors for power electronics, sensors, and control units.

- Internet of Things (IoT): Proliferation of connected devices increases demand for microcontrollers and low-power chips.

- 5G and Networking: Smartphones, base stations, and cloud infrastructure drive high-performance logic and RF components.

3.3 Pricing and Supply Constraints

Global supply-demand mismatches, such as those seen during the 2020–2022 chip shortage, led to prolonged delivery times and price increases. Factors include:

- Limited production capacity in advanced nodes.

- Equipment delivery delays (e.g., EUV lithography machines).

- Raw material constraints and logistical bottlenecks.

4. Geopolitical Influences

Semiconductors have become a strategic resource, intertwining technology, trade, and national security.

4.1 U.S.-China Technology Competition

- The U.S. has imposed export restrictions on advanced semiconductor equipment and IP to China, aiming to slow its development of high-end chips.

- Chinese companies are investing heavily in domestic fabrication capabilities, with government support for “Made in China 2025” initiatives.

4.2 Taiwan’s Strategic Role

- Taiwan produces a significant portion of the world’s advanced chips.

- Political instability or conflict could disrupt global supply chains.

4.3 European and Japanese Policies

- Europe aims to increase semiconductor self-sufficiency through initiatives like the European Chips Act.

- Japan focuses on materials and equipment supply chains, contributing critical components like photoresists.

5. Investment and Economic Significance

5.1 Capital Expenditure

Building a state-of-the-art fab costs tens of billions of dollars:

- TSMC’s 3 nm fab: estimated $20–25 billion.

- Advanced equipment from ASML (EUV lithography machines) costs $150 million per unit.

5.2 Market Size

- Global semiconductor revenue exceeded $700 billion in 2023, with logic, memory, and analog as major contributors.

- Projected growth is fueled by AI, automotive, and 5G applications.

5.3 Return on Investment

- Foundries rely on high utilization rates to recover massive upfront investments.

- Fabless companies benefit from design flexibility and faster time-to-market with lower capital risk.

6. Industry Challenges

6.1 Supply Chain Vulnerabilities

- COVID-19 exposed fragility in logistics and inventory management.

- Single points of failure, such as TSMC’s advanced fabs, create systemic risks.

6.2 Technological Bottlenecks

- Advanced nodes face physical scaling limits, requiring new materials, EUV adoption, and innovative transistor architectures.

- Talent shortages in semiconductor engineering and design add pressure on companies.

6.3 Geopolitical Risks

- Trade restrictions, export controls, and sanctions impact global collaboration.

- Countries are pursuing strategic autonomy, sometimes leading to duplication of infrastructure.

7. Strategies for Resilience and Growth

- Diversification of fabs: Countries and companies are investing in multiple locations to reduce geopolitical risk.

- Vertical integration: Some IDMs expand into foundry services to control the value chain.

- Public-private partnerships: Governments provide incentives for domestic semiconductor R&D and fabrication.

- Innovation: Investment in new materials, chiplets, 3D integration, and AI accelerators ensures competitive advantage.

8. Future Outlook

The semiconductor industry is poised for continued growth, driven by AI, EVs, 5G, IoT, and advanced computing. However, the industry faces challenges that require strategic coordination between governments, companies, and research institutions:

- Decentralized manufacturing: Reducing concentration in East Asia to mitigate geopolitical risks.

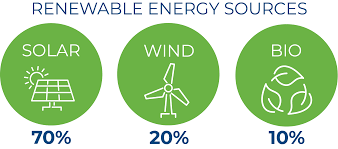

- Sustainable manufacturing: Lowering energy consumption and environmental impact.

- Advanced technology adoption: Quantum chips, photonics, and neuromorphic processors will shape the next decade.

The industry’s resilience, adaptability, and innovation capacity will determine its role in the global economy, technological leadership, and national security.

Conclusion

The semiconductor industry is a cornerstone of modern civilization, linking technology, economy, and geopolitics. Its complex value chain, dominated by a few leading players, illustrates both the opportunities and vulnerabilities inherent in globalized production. Market trends, emerging applications, and strategic considerations make semiconductors a high-stakes industry, where innovation and supply chain management are as critical as raw technical expertise.

Understanding the semiconductor industry requires a multidisciplinary perspective—combining economics, engineering, policy, and strategic foresight. As governments and corporations invest heavily in domestic fabrication, supply chain resilience, and next-generation technologies, the global semiconductor landscape is set for a transformative decade that will define technological leadership for years to come.